|

Mortgage rates had previously been forecasted to fall in 2023, but they’ve stayed higher for longer than expected in response to continued resilience in the U.S. economy, according to some of the nation’s leading real estate economists. As of early August, mortgage rates are nearly 7%.

As a baseline scenario, the 30-year fixed mortgage rate is expected to stay above 6% through the remainder of 2023, with a slim chance that rates will fall below that threshold by year-end. That’s due in part to the Federal Reserve’s hawkish monetary policy, with recent interest rate hikes essentially putting a floor under mortgage rates. In other words, rates may not rise meaningfully in the coming months, but they’re not likely to fall dramatically, either.

Here’s where mortgage rates are headed for the rest of the year and how that will impact the housing market as a whole.

Fannie Mae

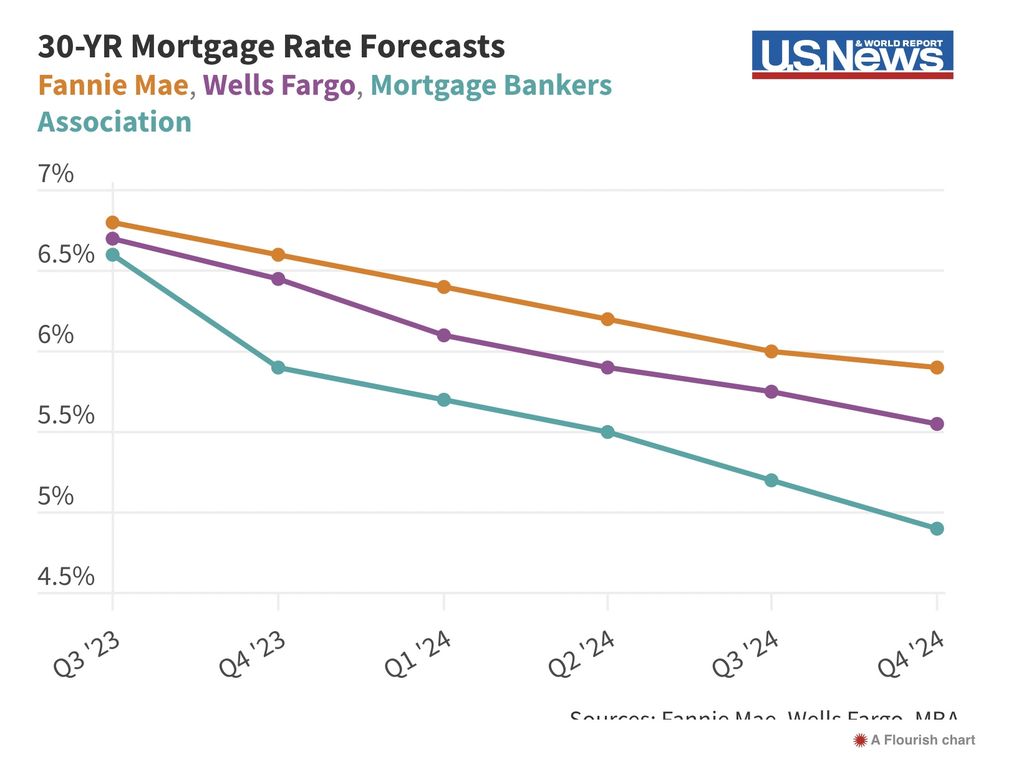

The latest monthly Housing Forecast from Fannie Mae, released July 19, has the average 30-year fixed rate remaining high at 6.8% during the third quarter of 2023, pulling back slightly to around 6.6% by year-end. The mortgage giant doesn’t expect rates to dip below 6% until the fourth quarter of 2024. All told, Fannie Mae expects the 30-year mortgage rate to average 6.6% in 2023 and 6.1% in 2024.

Mortgage Bankers Association

MBA’s July Mortgage Finance Forecast has a more optimistic outlook, with the 30-year mortgage rate falling to 5.9% by the end of 2023. Conditions improve in 2024, with the industry group projecting rates to fall below 5% in the fourth quarter.

“Our baseline economic forecast anticipates that interest rates will moderate over the next year and half, helping to break the current logjam in transaction activity and bringing relief to financing costs and property valuations,” said Jamie Woodwell, head of commercial real estate research at MBA, in an Aug. 3 statement.

Wells Fargo

In its latest U.S. Economic Outlook, Wells Fargo puts the 30-year conventional mortgage rate at 6.7% in the third quarter of 2023, pulling back somewhat to 6.45% in the fourth quarter. The bank’s forecasting group predicts that rates will fall below 6% in the second quarter of 2024.

National Association of Realtors

NAR expects mortgage rates to fall to 6.4% by year-end, declining further to 6% in 2024, the trade association predicts in a housing market outlook published July 27.

“With consumer price inflation calming close to the Federal Reserve’s desired conditions, mortgage rates look to have topped out,” says NAR chief economist Lawrence Yun in the report. “Given the ongoing job additions, any meaningful decline in mortgage rates could lead to a rush of buyers later in the year and into the next.”

Why Mortgage Rates Are Expected to Stay High

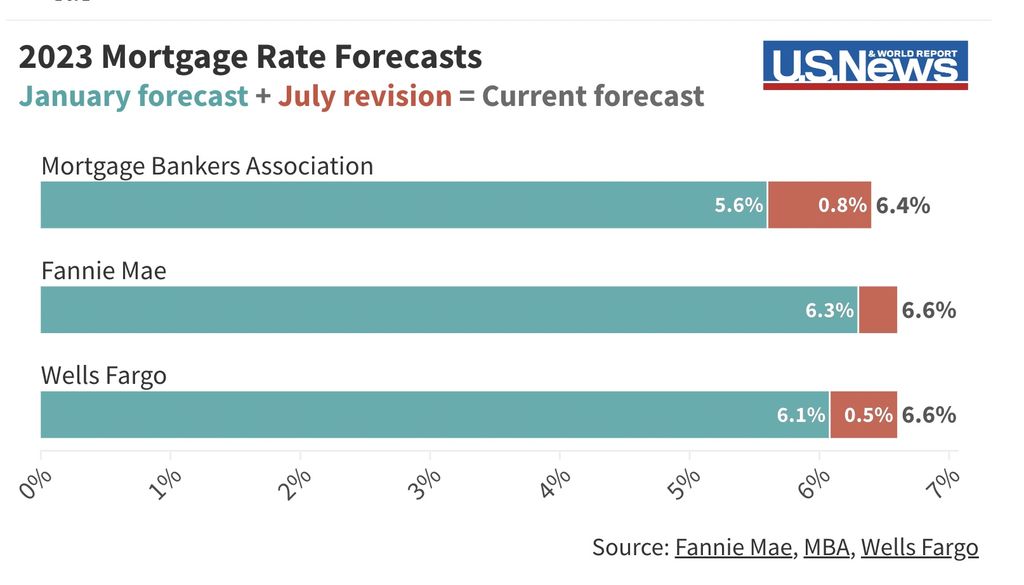

At the start of 2023, most economists predicted that mortgage rates would gradually decline throughout the year, but that forecast hasn’t come true. In fact, rates trended higher during the first half of 2023, reaching peak levels by late July and early August.

Industry groups have revised their forecasts upward over the past several months, accounting for developments in the U.S. economy that are keeping mortgage rates elevated. For example, Wells Fargo predicted rates would average 6.1% this year in its January outlook but amended its 2023 forecast to 6.6% in July – an upward revision of half a percentage point.

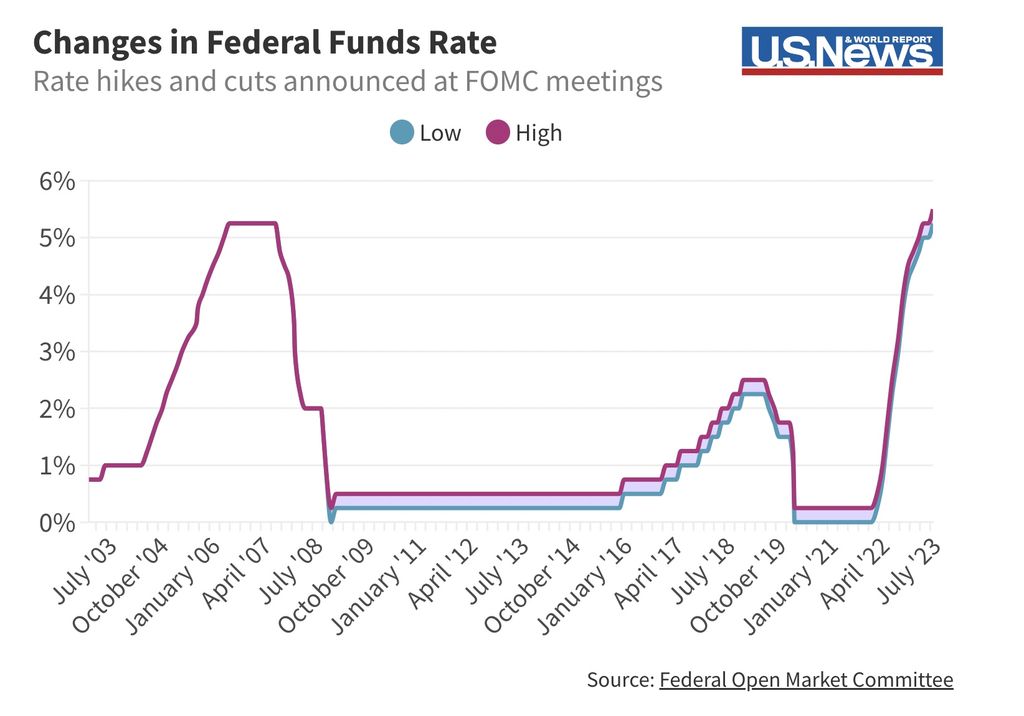

Stubbornly high mortgage rates are a byproduct of the Fed’s battle to bring annual inflation back to its 2% target. The central bank raised the federal funds rate seven times in 2022 and another four times so far in 2023, with the latest 25-basis-point rate hike coming at its July meeting.

“For real estate markets, the Federal Reserve’s decision translates into elevated borrowing costs through the remainder of 2023,” says George Ratiu, chief economist at Keeping Current Matters, a real estate market insights company.

In its latest projections materials, the Federal Open Market Committee – the committee within the Fed that sets monetary policy – expects the benchmark rate to end the year at 5.6%. The current rate is between 5.25% and 5.5%, and Fed officials have suggested that another rate hike this year isn’t necessarily off the table.

That being said, it’s not guaranteed that the FOMC will raise rates again before the year is out. It’s all dependent on incoming economic data on inflation and employment. If the economy continues to show unexpected strength, another rate hike may be necessary; but a slowdown in hiring or price growth may give Fed policymakers reason to pause.

“We will continue to make our decisions meeting by meeting, based on the totality of incoming data and their implications for the outlook for economic activity and inflation as well as the balance of risks,” said Fed Chair Jerome Powell at a July 26 press conference.

Finally, there’s the abnormally large spread between the 30-year fixed mortgage rate and the yield on 10-year Treasury bonds. That spread is historically around 1.8 percentage points, but it’s currently closer to 3 percentage points due to high levels of volatility on the investor side.

“While spreads have come in a bit recently, they remain well above longer-term levels and that means rates for consumers will likely stay elevated,” says Doug Duncan, Fannie Mae’s senior vice president and chief economist, in a July 19 statement.

Advice for Buying or Selling a Home in 2023 and Beyond

The bottom line is that mortgage rates are expected to stay elevated for at least the next couple of months, which has implications for prospective homebuyers and sellers. But regardless of current mortgage rate trends, Americans will still have a motivation to move, whether they want to downsize in retirement or need to relocate for a better job.

Here’s what you should consider if you’re planning on buying or selling a home in the near future.

What Buyers Should Know: Patience Doesn’t Always Pay Off

With stubbornly high home prices and 7% mortgage rates, many homebuyers understandably feel priced out of the current market. Two-thirds of prospective homebuyers are waiting for rates to fall before buying a home, according to a spring 2023 U.S. News survey.

At the time the survey was conducted in March, the Freddie Mac 30-year fixed mortgage rate was around 6.5%; but it’s been four months since then, and rates have actually risen to nearly 7%. To make matters worse, the median existing-home sales price rose from $375,400 in March to $410,200 in June, according to NAR. Suffice it to say, homebuying conditions did not improve for those who chose to wait.

Even if mortgage rates do fall, every slight drop brings with it a rise in homebuyer demand. That’s evidenced by MBA’s Weekly Applications Survey, which finds a meaningful uptick in mortgage purchase applications during weeks when rates are lower.

“Buyers who are waiting for lower rates will likely have some company. And if they’re OK with competitive market conditions, that can be a fine approach,” says Hale. “If you think you’re going to get a lower rate and still get the same market conditions that buyers have now, I think that’s a misconception.”

While mortgage rates can influence market conditions in the immediate term, there’s still a seasonality to home sales trends. Housing activity tends to pick up in the spring and summer months, losing steam in the fall and winter. Mortgage rates are still likely to pull back somewhat by the end of the year, and home sales prices tend to be lower during the off-season.

“For buyers who are not in a hurry, the fall and winter months could bring better values and a less competitive environment to find the right home,” Ratiu says.

Additionally, buyers may find less competition in the new home construction market. Homeowners may be reluctant to sell and sacrifice their low mortgage rates, but home builders remain eager to close the deal. Although new construction homes are typically more expensive than resale homes, builders may be willing to offer other concessions like price reductions or temporary interest rate buydowns.

What Sellers Should Know: Remember That You’re a Buyer, Too

Perhaps the biggest hurdle facing sellers is that they still need a place to live once they’ve sold their current home. For many, that means buying a new home at today’s rates and home prices. A recent Redfin study found that 92% of homeowners with a mortgage have a rate below 6%, and nearly a quarter (24%) have a rate below 3%.

“Mortgage rates probably won’t drop below 6% before the end of the year, and most homeowners wouldn’t be motivated to sell unless rates dropped further,” says Taylor Marr, Redfin’s deputy chief economist, in the report. “Some of them simply don’t want to take on a 6%-plus mortgage rate and some can’t afford to.”

But demand still exceeds supply in this seller’s market. July’s active listing count, or the number of homes listed for sale that aren’t pending, was down 6.4% compared with last year, according to Realtor.com’s Monthly Housing Market Trends Report. That’s after for-sale housing inventory was already at historically low levels this time last year.

Because it’s a seller’s market, home sales prices have stayed elevated despite the fact that buyers are grappling with 7% rates. Of course, this will vary from one region to the next, but in traditionally more affordable markets, competition remains high.

There is another silver lining for sellers who are also buyers: Most homeowners who have been at their current home for at least a few years are sitting on a mountain of equity thanks to double-digit home price appreciation seen during that time. With a successful sale, homeowners can tap into that equity to put toward their next home purchase.

Read: Best Mortgage Refinance Lenders.

What This Means for Mortgage Refinancing Rates

The forecast for mortgage refinance rates is pretty much the same as the forecast for mortgage purchase rates: They’re likely to stay elevated for longer than previously thought. Since the vast majority of homeowners have a lower rate than what’s currently available, it doesn’t really make sense to try to refinance to a lower rate right now.

Still, it’s possible to refinance if your goal isn’t just to get a lower rate. With rate-and-term refinancing, you can switch to a shorter repayment period, like a 15-year mortgage. Doing so can help you pay off your mortgage faster and save money in the long run, since you’ll be making fewer interest payments to the lender. Of course, if your new rate is much higher, it may not be worthwhile in the long term, and your monthly payments may be significantly more expensive in the short term.

Others may want to refinance as a way to switch from an adjustable-rate mortgage, or ARM, to a fixed-rate mortgage. Refinancing to a fixed rate can help shield you from higher monthly payments when the rate adjusts, which can make it easier to budget for your housing costs. However, fixed rates are generally higher than adjustable rates, so it may be difficult to justify a refinance unless your ARM rate is slated to increase meaningfully.

Additionally, some homeowners may want to refinance to access their home’s equity. A cash-out refinance is when you borrow a mortgage that’s larger than what you currently owe, allowing you to pocket your home’s equity in cash. This might be possible if your home’s value has risen dramatically or you’ve paid down your mortgage significantly over the past few years. But keep in mind that you’ll be taking on a larger loan amount and more debt, paying more money toward interest over time. Plus, you’ll still be stuck with a higher rate.

News Source: USA NEWS: MONEY