The Real Estate Market Outlook is suggesting a period of slow sales and less price growth ahead. For the next 4 to 6 months, sales will be subdued but by March 2022.

Most buyers are eager to find an opportunity to buy and thus avoid renting and losing their personal wealth. Growing one’s knowledge of the current real estate market can help sellers too find that same opportunity to sell their home fast. Success in buying and selling is in timing and persistence.

This slower period for sales won’t last as the Covid pandemic will recede and the economy will fully reopen. With the Fed announcing planned rate hikes in later 2022, home buyers will feel more impelled to buy a home in the next year. Higher employment and wage raises will add to the force of demand as prices rise. More sellers will list their home, but it won’t nearly be enough to satisfy demand.

Total sales of single-family homes, townhomes, condominiums and co-ops, fell 2.0% to an adjusted annual rate of 5.88 million in August. That is a 1.5% drop from 5.97 million homes sold last August of 2020.

Housing inventory has dropped to, to a new volume of 1.29 million units, which is 1.5% of less from July’s numbers and 13.4% less than 12 months ago (1.49 million). Unsold inventory of homes stayed the same at 2.6-months supply and that is down from 3.0 months home supply in August 2020.

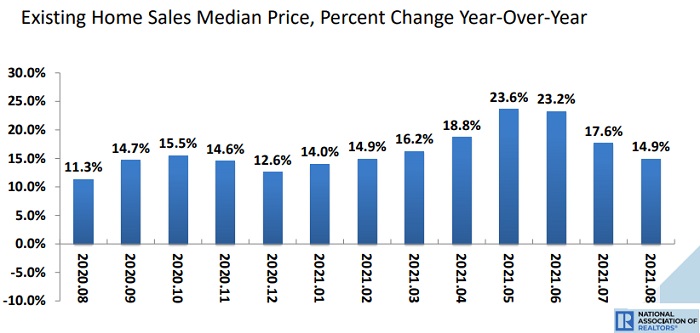

The median home price is up 14.9% from last year $310,400 to $356,700 and this is the 114th straight month that home prices have gone up in year-over-year gains.

“Sales slipped a bit in August as prices rose nationwide. Although there was a decline in home purchases, potential buyers are out and about searching, but much more measured about their financial limits, and simply waiting for more inventory.” said Lawrence Yun, NAR’s chief economist. “

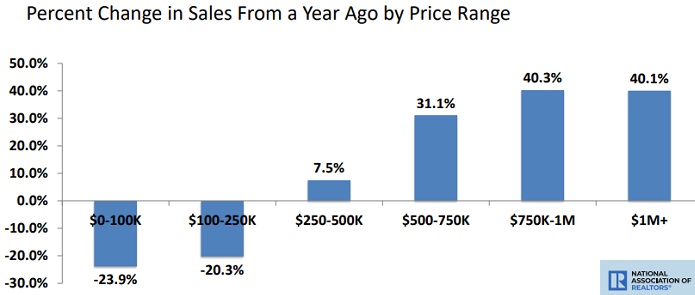

It appears first time buyers are dropping out of the market due to the high prices and a lack of homes at an affordable level. There may also be fewer reasons for first time buyers to buy given many are returning to the city to begin their pre-pandemic routine of commuting to their employers workplaces. Student loans are cited as an additional issue for Millennial buyers. Investors may still be heavily involved in purchasing real property, especially in the multifamily sector. First-time buyers accounted for 29% of sales in August, down from 30% in July and 33% in August 2020.

Sales of single-family detached houses fell 1.9% from July to an annual rate of 5.19 million in August. The number is down 2.8% from one year ago. The median price of a resale home sold in August rose $363,800 in August which is 15.6% more than 12 months ago.

Sales of resale condos and co-ops dropped 2.8% to an annual rate of 690,000 units vs 710,000 units in July. However this is still 9.5% higher than 12 months ago. The median existing condominium sold for $302,800 in August, which is up 10.8% from last August.

Home Sales and Prices